A company run by the distant relative of Abu Dhabi ruling family has agreed to lend 12 billion euros ($12.9 billion) to South Sudan in exchange for oil, according to a report.

The deal was negotiated on the sidelines of the COP28 climate change summit in Dubai in December, whose presidency at the time came under fire for allegedly looking to use the event as an opportunity to agree to lucrative new fossil fuel deals.

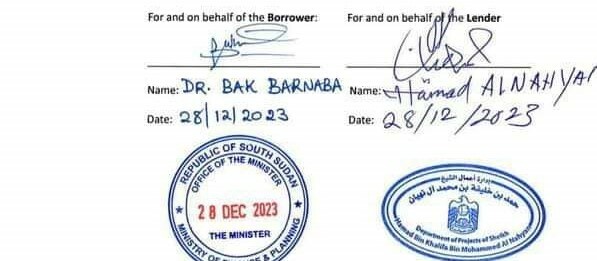

Bloomberg reported on Friday, citing an unpublished report by the United Nations Security Council-appointed panel of investigators, that the Dubai-based Hamad Bin Khalifa Department of Projects (HBK DOP) and South Sudan’s then-Finance Minister Dr. Bak Barnaba Chol had seemingly agreed to the loan in documents signed between December and February.

The HBK DOP loan would see South Sudan produce oil until at least 2043, years after the country’s current oil wells are expected to dry up.

South Sudan is heavily dependent on oil, with the commodity being responsible for 90% of the country’s revenue and nearly all of its exports, according to the World Bank. The country has been severely impacted by the Sudanese civil war, with food imports being disrupted and the country struggling to deal with the increasing influx of displaced Sudanese pouring into the country.

South Sudan has also seen a depreciation of its currency this year, fueled by rising immigration and a weakening economy. Citizens’ demand for US dollars has been further pressurizing the South Sudanese pound.

HBK DOP was founded by Sheikh Hamad Bin Khalifa Al Nahyan, a distant relative of Abu Dhabi’s ruling Al-Nahyan family. The loan will give the UAE discounted oil from South Sudan for up to two decades, and under the agreement South Sudan will receive $10 less per barrel of oil in comparison with the international benchmark, Bloomberg reported.

The UN document said that 70% of the loan will be used for infrastructure in South Sudan.

Although they can provide high returns if successful, often loans for oil can backfire and not be paid back. South Sudan has form in not paying back such deals. For example, UN-appointed investigators found that for a $446 million loan, the country paid just $95 million in fees, interest and costs. Investigators said in a report in 2021 that that shortfall resulted in a loss of almost 25% of government revenue, compared with if the oil had been sold through spot tender contracts.

Neither HBK DOP nor Chol responded to requests for comment.

The UAE company has previously been linked to buying a 49% stake in Beitar Jerusalem Football Club, but the bid was halted in 2021 after the soccer league questioned Sheikh Khalifa’s net worth and investments.

In 2020, HBK DOP partnered with several Israeli businessmen and Unit 8200, an intelligence division of Israeli military, to form a joint venture to develop cybersecurity solutions in the UAE.

The UAE has pledged more investment to African countries than any other country in the Middle East, Bloomberg reported. In February, a $35 billion UAE investment into cash-strapped Egypt was announced. The deal secures development rights for Ras el-Hekma, a coastal resort on the Mediterranean where a special economic zone will be set up.