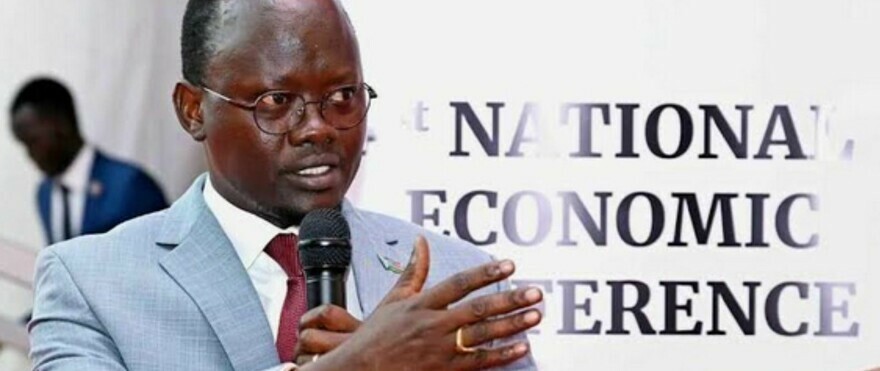

South Sudan’s Finance Minister Bak Barnaba Chol has taken a firm stance against the rampant issue of illegal interest rates in the country’s financial landscape.

Speaking in Juba on Thursday during the launch of the Association of Microfinance Institutions in South Sudan (AMISS), Minister Bak emphasized the necessity of adhering to the Bank of South Sudan’s laws, which mandate interest rates not exceeding 15%.

However, he pointed out the presence of exorbitant interest rates, exceeding a staggering 200%, with short-term maturity periods, deeming these practices illegal and detrimental to the country’s businesses.

“We are supposed to follow the Bank of South Sudan laws. The interest rate is clearly indicated as between 12 or 15%, but nobody is allowed to go beyond this rate set by the central bank,” Bak explained.

He further explained that illegal practices involving interest rates with extremely short maturity periods, such as one day or one month, need to be halted.

“You cannot give me a loan of 1,000 and expect me to pay 2,000 overnight. Where will I get the 1,000? Or you give me one million and you say within 30 days give me two million; where will I get this money? These are bad practices that must be stopped, and we will work very hard to stop it,” said Minister Bak.

“And by the way, both parties, the lender and the borrower, are criminals. Because you are not supposed to implicate yourself in a loan that you know is illegal. And also, the lender is not supposed to take advantage of or exploit your good heart because you are vulnerable and looking for a fast loan. So, he is exploiting you,” Minister Barnaba cautioned.

Finance Minister Barnaba highlighted the importance of recognizing technological challenges and outdated practices in microfinance institutions. He urged a swift transition to technology adoption for improved efficiency, emphasizing the benefits of computerized systems in simplifying tasks like data retrieval, ultimately enhancing operational efficiency.

Minister Barnaba also outlined the government’s commitment to fortify the microfinance sector, stating, “We are diligently working on a comprehensive plan to enhance both the regulations and the capacity of microfinance institutions. We are unveiling a new policy, and we are going to request commercial banks to allocate funds for more affordable loans to microfinances, making loans more accessible to the public.”

Furthermore, he highlighted the cultural aspects that impact borrowing and repayment behaviours, remarking, “There are cultural factors that require addressing. It’s essential to communicate to the people that borrowing is not only beneficial but also the responsible repayment is even more so. Repaying your loans in a timely manner not only helps you access more credit in the future but also aids in the growth of your business. These challenges are deeply rooted in our culture.”

Minister Bak pointed out the issue of financial illiteracy, noting, “There are individuals with businesses who struggle to produce financial statements and have difficulty distinguishing between assets and liabilities. It is the role of microfinance institutions to educate them on how to report their assets and liabilities, maintain financial statements, and monitor their accounting books.”

Regarding the challenge of commercial banks encroaching on the territory that should belong to microfinance institutions, he explained, “Our commercial banks often end up assuming the role of microfinance institutions due to their undercapitalization. They lack the financial resources to compete with larger banks such as Echo Bank and Cooperative Bank, leading them to undertake the work that should belong to microfinance institutions.” Minister Barnaba provided a solution, saying, “That’s why I emphasize the importance of your union.”

Regarding future endeavors, he highlighted government efforts to enhance regulations, echoing the request from the parliamentary Economic and Finance Committee for the Bank of South Sudan to develop a comprehensive plan. The focus is on strengthening the regulatory framework and boosting microfinance institutions’ capabilities through cooperation with the Central Bank and the Ministry of Finance.

He further revealed, “We plan to ask financial banks to set aside funds for more affordable loans to microfinance institutions, facilitating greater access to loans for the public.” Additionally, the Finance Minister disclosed, “The Ministry of Finance is presently developing a policy to allocate a budget that will be channelled through microfinance institutions, with a special focus on empowering youth and women.”

Aya Benjamin Warile, the Minister of Gender, Child, and Social Welfare, emphasized the importance of microfinance institutions safeguarding their clients, particularly women, to prevent gender-based violence. She expressed her ministry’s dedication to supporting AMISS, stating, “You should also protect the client and the vulnerable groups. We are concerned because empowering women to us means a lot, especially empowering them financially, which reduces their vulnerability to gender-based violence, a significant issue in our country.”

Furthermore, she reaffirmed her ministry’s commitment to collaborating with partners to promote gender equality within the nation, saying, “I would like to reaffirm the commitment of the Ministry of Gender, Child, and Social Welfare to work alongside all partners to ensure that gender equality is achieved in the country.”

The Association of Microfinance Institutions in South Sudan (AMISS) has a primary goal of creating a favourable operational and regulatory environment for microfinance institutions.

AMISS is a membership-based entity comprising microfinance institutions, Savings and Credit Co-Operative Societies (SACCOs), and related financial service providers that are registered and active in South Sudan. Serving as the central coordinating body, AMISS advocates on behalf of its members in all matters concerning the provision of financial services in the country.