South Sudan’s Parliament on Tuesday passed the Social Insurance Bill 2023 with all observations and amendments.

The South Sudan Social Insurance Bill guarantees that every employee, whether in the private sector, NGO, or government sector, is insured by a pension fund.

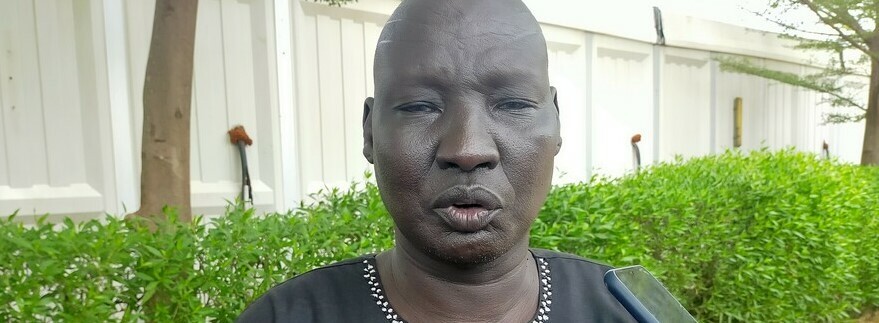

Addressing reporters after the session at Freedom Hall, John Agany, the parliamentary spokesperson, assured the citizens, especially those in the private sector, that the new law will benefit South Sudanese workers and pensioners.

The lawmaker said the parliament has also changed the name of the Bill from National Social Insurance Bill 2023 to South Sudan Social Insurance Bill 2023, pointing out that the Bill also helps the government benefit from the Personal Income Tax, mainly taken from employees.

“We have changed the name of this Bill from National Social Insurance Bill 2023 to South Sudan Social Insurance Bill 2023. So, now it has been passed in its final reading stage, and it has become a law and will be sent to the president,” he said.

“This bill is important because it organizes the private sector, and it gives a chance to the Republic of South Sudan to get investment in the money that comes with the investor in the field of public insurance,” Agany added.

He continued, “One of the burning issues is that we deal with both insurance for nationals and foreigners. Personal income tax is always collected from foreigners or even nationals, and the country benefits from that money.”

For his part, James Hoth Mai, the National Minister of Labour minister, said both nationals and foreigners will be required to pay the personal income tax to the South Sudanese government.

“My comment is on the name of the National Social Insurance Bill. We changed it to the South Sudan Social Insurance Bill; why? We meant this because when we say National Insurance Bill, it means only the people of South Sudan. But we have thousands of foreigners working in this country,” he stressed.

“We are providing security to the foreigners and so many things to them. So, we say that we want their contributions to be collected by the funds. And then we manage their money here in South Sudan,” he said.

Meanwhile, Victor Omuho Ohide, a member of parliament from Eastern Equatoria State presenting the opposition SPLM-IO, disputed the idea of taking money from foreign nationals working in South Sudan.

He says no section in the Bill discusses taking money from foreigners, saying it won’t be appropriate.

“The logic of bringing National Social Insurance there at first was to rally with the other members of East Africa. Secondly, when you read through the Bill, no section talks about money from foreigners working in South Sudan,” he stated.

Ohide further ruled out the idea of getting money from foreigners, saying that if money is collected from embassies, it will be paid to their respective countries.

He, however, requested that the Committee for Labor include a section in the Bill stating clearly that foreigners working in South Sudan will be taxed.