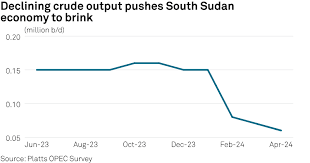

South Sudan, the newest country in the world, is currently facing an economic crisis unseen in its history. The conflict in Sudan and the disruption of the oil pipelines from South Sudan to Port Sudan have exposed South Sudan’s financial mismanagement, corruption, and decades of lack of development.

Since independence, instead of investing in infrastructure and alternative pipelines, oil refineries, and roads to transport refined petroleum domestically and to neighboring countries, South Sudan’s government has focused on corruption and excessive borrowing, which has become unsustainable and now risks collapsing the country.

Last month, protests took place in Bor, Wau, and Rumbek with the employees of the three public universities there demanding seven months of unpaid salaries. As recently reported by Radio Tamazuj, demonstrations held on 17 and 24 June in Bor drew diverse groups, including civil society activists, women, youth, businesspeople, and others. The peaceful protesters aimed to raise awareness about pressing issues such as the exorbitant cost of living, delayed payment of government salaries, escalating insecurity, and burdensome taxes on local businesses.

On 30 of June, the Ministry of Finance and Planning informed the government agencies and the public that “all payments will be suspended until further notice.” He added that the ministry will not process new claims until the 2024-2025 budget is passed by the Transitional National Legislative Assembly and receives legal assent. This includes government employees who have not been paid for the last seven months. On Wednesday, President Salva Kiir sacked Awow Daniel Chuang, the country’s finance minister. However, the government has been spending large amounts of money building new headquarters which are now completed including the new nine-story Nilepet headquarters in Juba, completed in March 2024, which cost nearly US$30 million. More recently is the completion of the Bank of South Sudan’s new headquarters in Juba which was opened on Monday.

The Bank’s Governor, James Alic Garang, said the new building will not only improve the service delivery efficiency of the apex bank but also attract foreign investment and help stabilize the financial sector. South Sudan is the only country that believes building a US$30 million office attracts foreign investment, while defaulting on a US$541 million loan, printing money into oblivion, causing high inflation, and failing to pay government salaries and allowances for seven months.

South Sudan’s total public debt was estimated at US$3.72 billion (51 percent of GDP) as of June 2023, according to the International Monetary Fund (IMF). This has not stopped the country from seeking more debt without addressing the fundamental issue, which is corruption and insecurity. The primary insecurity seems to be caused by those within the government who believe that if there is insecurity, then the upcoming elections in 2024 should be extended. Youth crime and theft have continued to increase in Juba, which is likely instigated by some individuals in the military, perhaps due to unpaid salaries, and thus create the desired insecurity to postpone the elections.

In the last 12 months alone, two separate international courts ordered South Sudan to pay US$3.7 billion in total and defaulted on a US$541 million loan. South Sudan has agreed with Ethiopia to build a 220-km cross-border road, following a US$738 million financial agreement signed in May 2023, with South Sudan as the borrower and Ethiopia as the financier. Repayment involves crude oil from South Sudan to Ethiopia. This road should have been constructed in 2011, not after the war in Sudan, and certainly not to begin construction 15 months later. Meanwhile, Governor James Alic Garang said the country is seeking US$250 million in financing from the IMF to address the balance of payment challenges and boost growth. In reality, this growth will only fill the pockets of government officials. As Mark Twain said, “It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.” For the government, the belief is that more money will solve their problems while the money is being stolen by officials and their business partners without fear or shame.

In August 2023, the Swiss Federal Supreme Court rejected South Sudan’s bid to overturn a partial award in a US$2.7 billion ICC dispute with a Lebanese-owned mobile operator over a license issued before the state gained independence. The Court found that South Sudan is bound by an arbitration clause in a license agreement that was entered into by Sudan before South Sudan’s independence. Instead of requiring a new license, new terms and conditions, and arbitration in South Sudanese courts when the country gained independence, the government sought to leave it as it was. A ministerial decree of 2012 confirmed that the licensee was accepted as a “duly licensed Telecommunications Operator within the Republic of South Sudan under the terms and conditions of [its] original license issued by the Republic of Sudan,” according to Schellenberg Wittmer.

This was incompetent and cost the country US$2.7 billion in damages. The largest telecommunication company in Africa is MTN Group which has a market capitalization of US$8.5 billion. This means the damages paid can buy a 31.72 percent stake in MTN Group which has a total of 295 million mobile subscribers across the Group’s markets. Whereas South Sudan has only 3.27 million mobile subscribers as of 2022. The damages awarded by the court were unfair and excessive. This burden is ultimately put on the people of South Sudan.

In May 2024, South Sudan was ordered by the International Centre for Settlement of Investment Disputes (ICSID) to pay US$1 billion to Qatar National Bank after losing a court case due to a debt the country was unable to pay back Qatar Bank. The original loan was a US$700 million loan received by South Sudan in 2012. There was US$541 million which was remaining at the end of FY2022/23. These two court cases have cost South Sudan around US$3.7 billion within the last 12 months, money the country does not have. There are valid reasons South Sudan should not pay them back, especially the US$2.7 billion award to Vivacell Telecom because it is predatory and excessive. In regards to Qatar Bank, this is the risk the Bank took, why should they be rewarded?

If companies give loans to developing countries knowing they cannot pay back the money but when the country defaults on the loan, the creditor goes to an international court where they are awarded their money or more back. These rulings encourage predatory lending to developing countries to control them. This is evidenced currently by the US$13 billion oil-backed loan from a UAE company, Hamad Bin Khalifa Department of Projects, to South Sudan, according to U.N. experts. This is predatory lending because the government of South Sudan is unable to pay back this amount of loan. It seems there is a sinister agenda behind the UAE company giving such a loan to a country that recently defaulted on a US$600 million loan and is in the midst of an economic crisis. But perhaps the international courts will always favor them, so the UEA company has nothing to worry about. It is setting zero risk to creditors that loan hundreds of millions and billions of dollars to developing countries that cannot pay the loans back. As interest rates are currently high, if this company invested in a U.S. 10-year Treasury bond, it would receive 4.271% annually, which is around US$555,230,000 per year. So, why risk US$13 billion on a country that is economically struggling and has not been able to pay back its loans?

The government needs to be reduced, including the current 35 national ministers down to 10 to 12 ministries through merging ministries and eliminating some. For example, the Ministry of Higher Education, Science and Technology, and the Ministry of General Education and Instruction should be merged to form the Ministry of Education. The Ministry of Environment and Forestry, the Ministry of Livestock and Fisheries, and the Ministry of Agriculture should be merged to form the Ministry of Environment and Agriculture. Some ministries should be eliminated, and the number of ministries should be reduced to around 10 to 12. Additionally, decisions by committees and the Council of Ministers should be very limited due to unnecessary bureaucracy, slow pace, and the shielding of responsibility and accountability. Although decision-making is done collectively, they are never held collectively accountable for the actions they take.

This is a time of reckoning, and business as usual is no longer sustainable. The ministers and the parties have benefited for far too long. It is now time to have a reality check and work for the interest of the people. The government needs to get into the business of producing oil and mining rather than relying on taxing citizens or money printing. Even with oil, the state-owned Nilepet only owns 7 percent of the three main oil-producing companies in South Sudan, with 93 percent being owned by foreign investors. So, we need to remove exclusive oil licenses to allow Nilepet to establish oil-producing companies that Nilepet would own 100 percent and operate. These measures, if not implemented, will lead to the collapse of the economy, and the longer government employees are not paid, the more protests will happen. At some point, the protests will become large, frustration will grow, and they will eventually demand the removal of the entire government.

The government of South Sudan must urgently address corruption through a policy of zero tolerance, stop borrowing money, reduce the size of the government including ministries, appoint competent ministers, eliminate committees and collective decision-making, focus on production, reduce taxation to relieve cost of living on citizens, fix flooding, and remove exclusive oil licenses to allow Nilepet to operate.

The cost of living is having a massive negative effect on citizens, especially those in rural areas where services and employment opportunities are very limited, far from Juba where ministers travel in Toyota V8 convoys, and the arrogance of ministers is becoming frustrating. If these serious actions are not taken by South Sudan’s government, the economy will continue to collapse and the entire government will be forced out.

The writer, Atak Ngor, can be reached via Twitter: @atakngor

The views expressed in ‘opinion’ articles published by Radio Tamazuj are solely those of the writer. The veracity of any claims made is the responsibility of the author, not Radio Tamazuj.