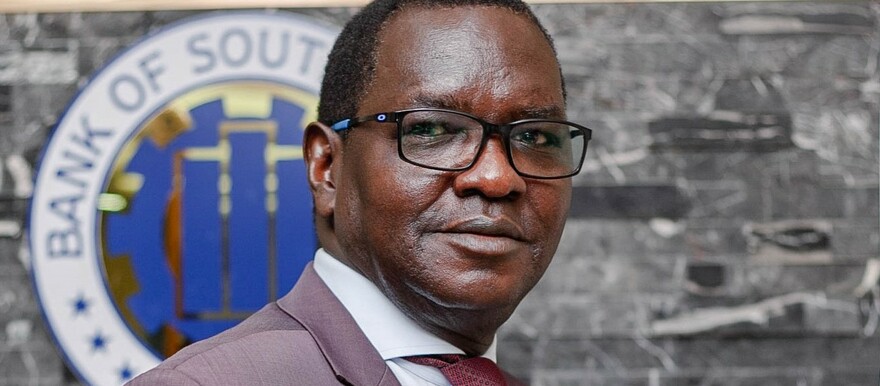

Johnny Ohisa Damian has been appointed governor of South Sudan’s central bank, according to a presidential decree issued on Thursday night.

In the decree read on state-run television, President Salva Kiir cited his constitutional powers to appoint and remove public servants and appointed Mr Johnny Ohisa as the Governor of the Central Bank with effect from August 25, 2021.

Ohisa had served as first deputy governor and bank governor on an interim basis since the first week of August 2022 after the removal of Moses Makur Deng.

Before being appointed first deputy governor earlier this month, Ohisa served as Director-General for Currency and Banking Operations at the bank from 17 May 2019 to 30 April 2021.

Mr. Ohisa joined the central bank from International Commercial Bank (ICB-SS), where he served as a Deputy Managing Director and later as Managing Director.

Before joining ICB-SS, he worked for the United States Agency for International Development (USAID) as a Program Budget analyst and later as an Assistance Specialist and later a Senior Acquisition and Assistance Specialist for the United States Agency for International Development (USAID) in Sudan, Kenya and the Democratic Republic of Congo (DRC).

Mr. Ohisa also worked for World Vision International in Kenya.

He holds a Master’s Degree in Development Finance from the University of Reading in the United Kingdom and a Bachelor’s Degree in Banking and Export from Sudan University of Science and Technology, formerly Khartoum Polytechnic, Sudan.

In another decree, President Kiir appointed Addis Ababa Othow as the first deputy governor of the central bank. He also appointed John Machiek as the second deputy bank governor.

The appointments came amid hyperinflation and depreciation of the country’s local currency, the South Sudanese pound (SSP).

The country depends on oil revenues to finance up to 95 percent of its budget.

The central bank has been auctioning millions of US dollars to forex bureaus and commercial banks as a measure to stabilize the exchange rates. However, the situation has continued to deteriorate as market prices soar.