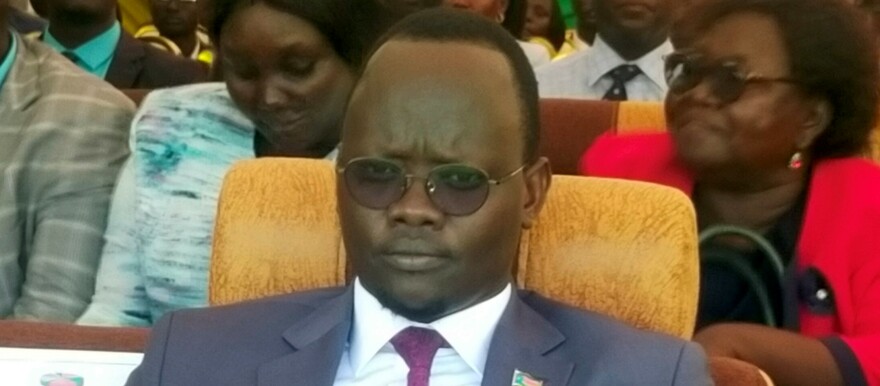

South Sudan’s newly appointed Finance Minister, Bak Barnaba Chol, has announced intentions to raise taxes on luxury vehicles and high-end products, including V8 cars.

Speaking during his inaugural address at the Ministry of Finance in Juba on Monday, Minister Barnaba emphasized the need to discourage extravagant spending on luxury items that strain the nation’s financial resources.

“We are going to discourage people from buying luxury cars like V8, V6 engine cars,” Minister Barnaba declared. “These expensive commodities are very costly to our economy. V8 is nice but very expensive to our budget, and that is why I am going to increase taxes together with the Commissioner General of the National Revenue Authority (NRA). We are going to increase tariffs on luxury goods and because we want to bring food to the hungry people.”

Minister Barnaba highlighted the administration’s dedication to transforming the economy collaboratively with experts and citizens. He urged the populace to focus on domestic food production rather than indulging in extravagant spending. “The road to economic transformation will be too rough,” Barnaba acknowledged. “I know I will be called names, I will be opposed. I might even be threatened with death but I want to promise that I will stand my ground, I will try my best.”

He underscored his commitment to pursuing a new path to economic recovery and reform that would ultimately benefit the majority. “Change is inevitable, and there is no right time for change,” Minister Barnaba emphasized. “I believe the time might have come.”

In the coming weeks or months, the Finance Minister is set to introduce an “economic emergencies intervention plan.” This policy aims to stabilize the foreign exchange market and mitigate the effects of skyrocketing market prices. Additionally, the plan will accelerate the implementation of public financial management reforms.

Minister Barnaba also discussed plans to discourage the over-dependence of South Sudanese citizens on the U.S. dollar. He proposed providing local currencies of the region, such as Ugandan shillings, to individuals traveling to neighbouring countries instead of dollars.

“We are going to introduce policies that will discourage people from looking for dollars,” Barnaba stressed. “If you are going to Kampala for instance or Nairobi, we will give you shillings because you don’t need dollars to go to Kampala; you just need Uganda shillings.”

Athian Diing Athian, the Commissioner General, supported the Finance Ministry’s drive to enhance revenue collection by expanding the tax base. He noted that a significant portion of South Sudan’s population does not currently contribute to tax revenues.

Furthermore, Diing advocated for the review of the Status of Force Agreement (SOFA) signed with the United Nations. He pointed out that the government loses substantial revenue through exemptions, not only for the UN but also for contractors who are typically exempted from taxes.

“South Sudan is the only country where if you get a contract from the government and you come back to the same government and ask for an exemption and it is given, nobody says no,” Diing remarked. He emphasized the need to revise the SOFA to ensure that exemptions align with the nation’s economic goals and do not inadvertently impact the local market.