South Sudan’s Minister of Finance and Planning over the weekend called on the National Revenue Authority (NRA) to ensure effective tax collection and the removal of multiple roadblocks across the country.

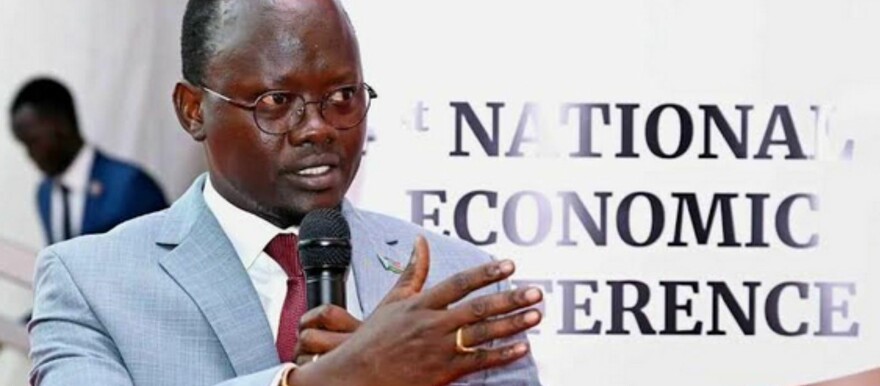

Dr. Bak Barnaba Chol made the remarks while addressing the closing of South Sudan’s first National Economic Conference in Juba on Saturday.

“One of the foundation pillars of any driving economy is a robust and efficient taxation system. It is evident that our National Revenue Authority requires an efficient system for tax collection in addition to other taxes that are not currently collected,” he said. “We delved into the complexities of multiple taxes collected by both the national and the state governments and how this has created an increase in essential goods prices, and how to harmonize these collections so that the burden does not go to our citizens.”

“I actually plan to tour all the (tax) collection points in this country to see why taxes are not streamlined, why there are so many roadblocks along the way to Juba, and why there is a lack of transparency and accountability in revenue collection,” Dr. Chol added.

He revealed that the conference centered on critical sectors such as diversification of the economy by focusing on agriculture, mining, live stocks, wildlife, and tourism.

“The delegates also further debated on banking regulations, infrastructure, human capital, trade, access to market, governance, and policy framework among other topics,” he said.

South Sudan has a complicated tax collection system that involves multiple taxation by both the national and the state governments.