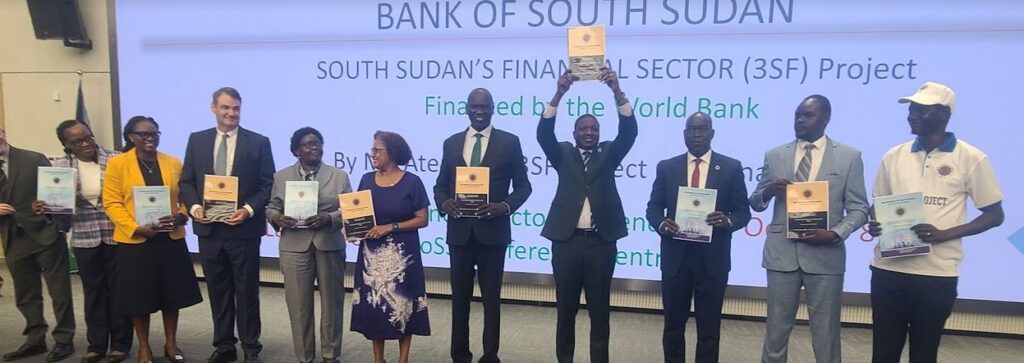

The Bank of South Sudan on Tuesday unveiled the Strengthening South Sudan’s Financial Sector (3SF), a USD 18 million initiative designed to enhance the country’s financial system.

This project whose objective is to strengthen the institutional and supervisory capacity of the Bank of South Sudan and improve the efficiency of core financial sector infrastructure will run for 5 years until September 2028.

According to the Bank’s management, the project’s main objectives include investing in strengthening the regulator.

The project intends to formulate financial sector policies, establish a banking and financial institute, development of a financial sector development strategy and roadmap for the Bank, technical assistance and capacity building for BoSS staff on financial sector development, and develop of monitoring framework to assess implementation among others.

Speaking during the launch, BoSS Governor Dr. James Alic Garang said the project aims to modernize South Sudan’s financial systems.

“We believe that this project will allow us to exert our efforts in our attempt to modernize the Bank and at the same time, I would like to strengthen the broader financial sector in this country. We believe this is the project that the Bank of South Sudan is highly committed to implementing,” he said. “On behalf of South Sudan, I reaffirm our commitment to implement the 3SF project that we just launched today and I call upon the Ministry of Finance and different government agencies that are related to this function and all the other stakeholders, including Bank of South Sudan, to support this project.”

For her part, Maryam Salim, the World Bank Country Director for South Sudan, Sudan, and Ethiopia said upgrading the Bank’s IT infrastructure is one of the project’s activities.

“Enhancing the Bank of South Sudan’s regulatory and supervisory framework, addressing skill and capacity gaps, and supporting the upgrading of critical IT infrastructure is central to the project and essential for supporting the Bank of South Sudan in fulfilling its mandate to support the stable and more resilient financial sector,” Salim said. “Furthermore, the previous project places a strong emphasis on promoting financial integrity and combating money laundering and the financing of terrorism.”

“By enhancing the capacity of the financial intelligence unit, we can improve the protection and prevention and listed financial activities, thereby safeguarding the integrity of the financial system,” she added.

The World Bank official stressed that by strengthening these critical aspects, they can contribute to a more secure and transparent financial sector, which is essential for attracting investment, fostering economic growth, and protecting the country from the harmful effects of financial crime.