The Governor of the Bank of South Sudan (BoSS) has said the Bank of South Sudan Act 2011 and the Banking Act 2012 should be amended to give the Central Bank more powers to monitor commercial banks and the banking system in the country.

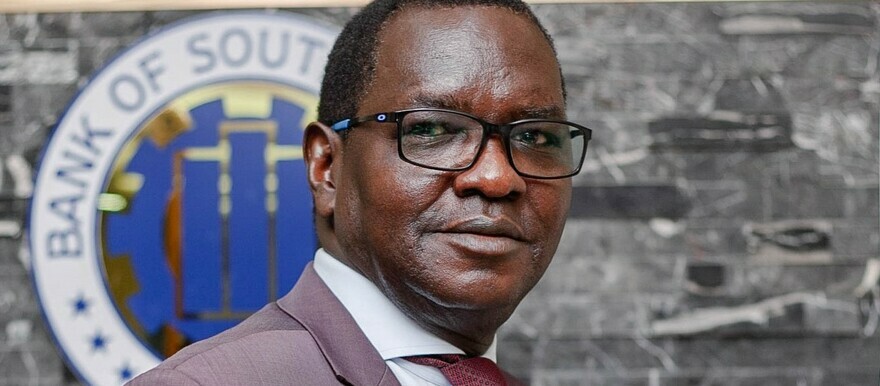

Johnny Ohisa made the remarks on Tuesday in Juba during a stakeholders meeting which was attended by members of the National Constitution Amendment Committee (NCAC) to review the banking laws.

“We have been trying to amend the BoSS Act for the last 10 years, and this is now an opportunity for us to amend and strengthen the Act so that it gives the Central Bank more power to implement its monitoring role,” he said. “A healthy financial system is viewed as an important tool to propel the sustainable growth and development of the economy. It is on this background that the review of both the Bank of South Sudan Act 2011 and the Banking Act 2012 comes in handy.”

According to Governor Ohisa, the two laws are good, but it is important to enrich them to suit the current situation to serve everybody.

“We need to enrich and also improve on the Acts to ensure that it serves everybody well,” he said. “The law itself is good, but there is a need for amendments, and we need to include some things that have not been there before.”

The governor said that despite the challenges the central bank faced, it has managed to transit a new era of governance and economic and financial reforms.

He encouraged the National Constitution Amendment Committee (NCAC), the body responsible for reviewing legislation in South Sudan, to make efforts in making the legislation reform agenda a success.

“The power and agility of a monitoring policy tool in regulating and challenging liquidity in the banking industry cannot be over-emphasized,” he stressed. “Across the board, policymakers face uncertainties and difficulties; however, we must anchor our fate on making the legislation reform agenda a success.”